Exclusive Corporate Membership Options

Elevate your firm’s position in the financial advisory sector with our elite Founders’ Club memberships, strictly limited to 100 corporate entities. This membership propels your firm to the forefront of the financial advisory field, enabling collaboration, igniting innovation, and stimulating organic growth. It positions you and your team as thought leaders, arming your executive team and financial advisors with insights that win.

For a yearly investment of $ 30,000, choose between the Wealth Management Mastery Series or the Wealthy Elite Series. Each offers access to targeted research, strategic insights, thought leadership tools, and the coveted CEO Summit. For firms serving the affluent and ultra-affluent markets, our bundled package at $50,000 annually combines these series, offering an all-encompassing approach to leadership and insight into wealth management. Wealth Management Consortium.

This membership propels your firm to the forefront of the financial advisory field, enabling collaboration, igniting innovation, and stimulating organic growth. It positions you and your team as thought leaders, arming your executive team and financial advisors with insights that win.

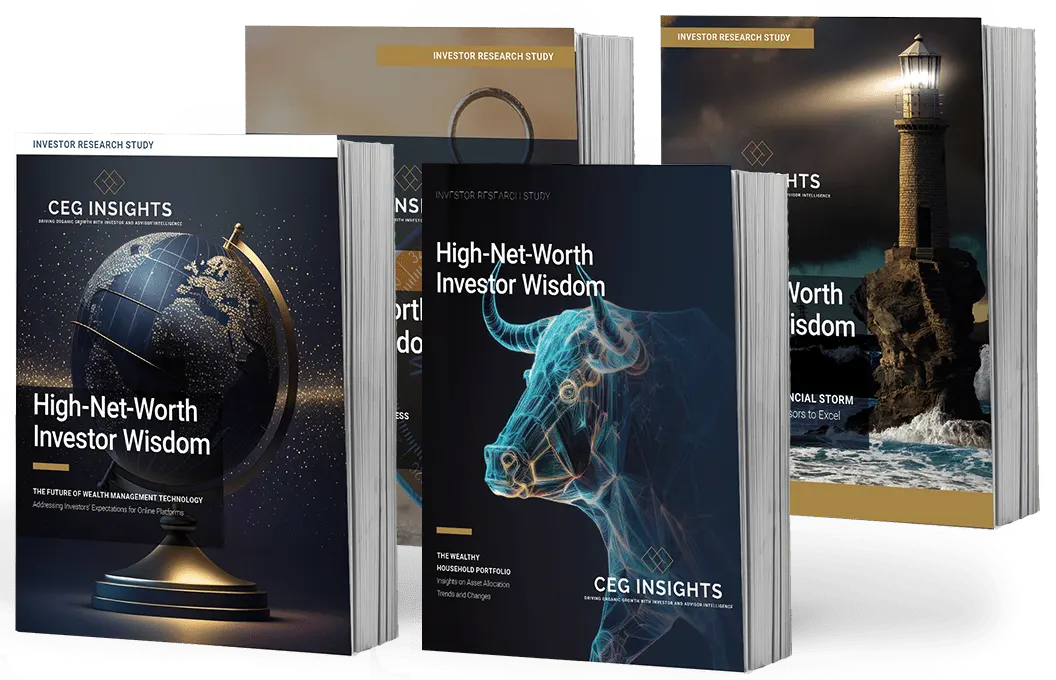

Cutting-Edge Affluent Research and Advisor Best Practices for Driving Results

High-Net-Worth Investor Wisdom

Weathering the Financial Storm: Empowering Financial Advisors to Excel with Wealthy Clients provides valuable insights into what high-net-worth individuals want and need when it comes to wealth management services. The study also provides a roadmap for financial advisors to meet and exceed these expectations, allowing them to build strong relationships and drive significant business results. With its detailed examination of the attitudes and behaviors of the affluent, this study is invaluable for staying ahead of the curve and helping your advisors succeed in today’s competitive wealth management industry.

Get invaluable insights into the expectations and needs of high-net-worth individuals with Wealth Management Success. This in-depth study can be purchased for $9,500.

The Journey to Financial Success: A Guide to Understanding and Achieving Investors’ Goals and Aspirations provides a deep understanding of clients’ goals and aspirations, along with how advisors can communicate effectively with them to help them achieve their financial goals. Through its exploration of the latest trends and best practices, this study also provides a blueprint for financial advisors to create customized wealth management solutions aligned with their clients’ goals and expectations. Armed with this information, you can ensure that your advisors can meet their client’s changing needs and build trusted, long-lasting relationships that achieve clients’ most important goals.

Gain a deep understanding of clients’ goals and aspirations with The Journey to Financial Success. This comprehensive study is priced at $9,500.

The Future of Wealth Management Technology: Addressing Investors’ Expectations for Online Platforms explores the changing landscape of wealth management technology and its role in meeting affluent clients’ expectations. The study takes an in-depth look at the latest trends and advancements in online wealth management platforms and assesses the benefits and limitations of each. By spotlighting the current and future state of wealth management technology and evolving needs of investors, this study equips you and your advisors with the knowledge and insights you need to remain competitive and meet the ever-growing expectations of clients.

Stay ahead of the curve with the Future of Wealth Management Technology. This comprehensive study is priced at $9,500.

The Wealthy Household Portfolio: Insights on Asset Allocation Trends and Changes provides a comprehensive look at the current asset allocation landscape for affluent households. It offers in-depth insights into the asset allocation strategies of the wealthy, including recent changes in asset allocation trends such as the shift toward alternative investments and the impact of global events on portfolio composition. This study will keep you and your advisors current on the investment preferences of the affluent—information that is crucial for advisors to effectively address their client’s investment goals and stay ahead of their competition.

Get a comprehensive look at the current asset allocation landscape for affluent households with The Wealthy Household Portfolio. This in-depth study is priced at $9,500.

Cutting-Edge Affluent Research and Advisor Best Practices for Driving Results

The Wealthy Elite

Attracting and Retaining the Ultra-Wealthy: A Study of Investor Habits, Attitudes, and Advisor Relationships delves into this demographic’s unique challenges and expectations and offers insights into the most effective strategies for attracting and retaining these high-net-worth clients. In addition, the study provides valuable information on building solid and lasting relationships with ultra-wealthy investors along with a roadmap for advisors to deliver the level of service and expertise that these clients demand. Whether advisors are looking to better understand the ultra-wealthy market or want strategies to expand their wealthy client base, Attracting and Retaining the Ultra-Wealthy is a must-read for advisors aiming to grow their success by serving affluent clients extremely well.

Explore the unique financial goals of the ultra-wealthy with Attracting and Retaining the Ultra-Wealthy. This in-depth study is priced at $25,000.

Wealth Creation for Entrepreneurs: Analyzing the Advisor-Client Dynamic in Building Personal Wealth delves into the challenges, opportunities and best practices in working with entrepreneurs and business owners. In addition, the research provides insights into how financial advisors can better attract and serve these clients to help them achieve their wealth-creation objectives. The study is a valuable resource for financial services executives and advisors looking better to understand the dynamics of this vital client segment and to enhance their value proposition—all while supporting entrepreneurs on their journey to financial success.

Explore the unique financial goals and needs of entrepreneurs and business owners with Wealth Creation for Entrepreneurs. This in-depth study is priced at $25,000.

Accelerate Organic Growth with Our Comprehensive Thought Leadership Tools

As a Founders’ Club Member, you receive unrestricted access to our advanced thought leadership tools. These resources, ideal for keynote presentations, articles, webinars, podcasts, and training your financial advisors, are crafted to elevate your visibility, foster engagement, and establish your prominence in wealth management. By leveraging these insights from our pivotal research, you can convert knowledge into practical, actionable steps that drive you closer to your net organic growth objectives. Citing CEG Insights when using these resources fulfills your obligation and reinforces the authority and credibility of your communications.

Unleash the Power of Our Thought Leadership Resources for Your Business and Financial Advisors

Your all-encompassing platform for thought leadership resources and tools. This portal supports you in refining your presentations and communication for optimal audience connection. With our resources, you can stay current with wealth management trends and best practices, enhancing your competitive advantage.

Thought Leadership Portal

Your all-encompassing platform for thought leadership resources and tools, this portal supports you in refining your presentations and communications for optimal audience connection. With our resources, you can stay current with wealth management trends and best practices, enhancing your competitive advantage. Delve into the Thought Leadership Portal and enhance your communications and outcomes.

Published Articles for Repurposing

Our thought-provoking and informative articles, published in Financial Advisor Magazine, delve deeper into the key findings from each study in the Wealth Management Mastery series. These articles give you and your advisors a profound understanding of industry trends and best practices. Importantly, you have our permission to repurpose these articles using artificial intelligence as a foundation for your publications. Please ensure to cite any charts or tables from CEG Insights that you use in your repurposed content.

The Play to Win Special Report

The concise distillation of each research study from the Wealth Management Mastery series provides specific, actionable strategies for advisors to increase their success. Keeping your advisors updated on the latest wealth management trends and best practices is essential. Empower your advisors with this report and enhance their ability to serve high-net-worth clients more effectively. This report is your gateway to equipping your financial advisors with the crucial findings from the Mastery series.

Customizable Webinar Assets

Our webinar resources for each study, including a slide deck, script, and pre-recorded webinar, are designed to serve as foundational material to repurpose in educating your advisors on research findings and best practices. Each webinar is engaging, informative, and actionable, providing a solid base for you to create presentations that will empower your advisors to accelerate their success. Utilize these resources to enhance performance and client service and drive your team’s success to new heights.

Play to Win Keynote Slides

These slides offer a visually dynamic and powerful medium to convey key insights from the Wealth Management Mastery series. These slides are a crucial educational asset for advisors, keeping them abreast of industry trends and best practices. Advisors can also utilize these slides with clients and prospects to clarify essential concepts and stimulate action. These are the PowerPoint slides from the Play to Win report, available for use in any presentation with appropriate recognition of CEG Insights.

Fireside Chat and Podcast Interview Guide

Our meticulously crafted guides help financial service executives confidently prepare for interviews, with a specialized focus on showcasing their expertise. These guides offer recommended questions and compelling responses, enabling you to discuss research findings and best practices confidently. Empower your financial advisor audiences to thrive by sharing expert insights and establishing yourself as a thought leader. Leverage these guides to amplify your appearance and elevate your industry profile.

Mastery Series Infographics

Our infographics deliver clear, concise overviews of the critical findings from each report in the Wealth Management Mastery series. They are a practical resource for sharing these insights with your team and advisors. Advisors can then share them with clients and prospects to help them understand investor best practices.

Dynamic Social Media Toolkit

Our toolkit offers a comprehensive range of pre-crafted tweets, Facebook posts, and LinkedIn updates. These assets allow you to effectively promote the research and educate your advisors on the latest industry trends and best practices. In addition, these social media assets are engaging, informative, and shareable, potent tools for brand promotion and visibility. Leverage this toolkit to amplify your brand’s presence and influence in the digital space.

CEO Summit: Exclusive Access for Founders’ Club Members

As a valued Founders’ Club member, you are granted an exclusive, complimentary invitation to the CEO Summit, the pinnacle of financial leadership gatherings. This semi-annual event, which alternates between the coasts of the United States, is a distinctive forum for C-level and top executives to shape the future of wealth management together.

Mark your calendars for our inaugural session in Q4 2024 on the West Coast—an assembly of events, excellence, innovation, and strategic advancement. Here, you’ll engage in pivotal discussions, connect with industry visionaries, and uncover actionable insights designed for the zenith of executive leadership.

Your voice at the CEO Summit is instrumental in steering the conversation toward the most urgent topics in wealth management, blending thought leadership, pioneering research, and peerless networking opportunities. It’s an arena where collaborative thought and high-caliber idea exchange pave the way for industry leadership.

This is your opportunity to help set a new benchmark for executive conferences in the financial services domain. As a Founders’ Club member, your place among the elite at the CEO Summit is assured—join us and transform the wealth management landscape.

Wealth Management Consortium

Step into the exclusive circle of the Founders’ Club and unlock your membership to the Wealth Management Consortium. This isn’t just a membership—it’s a launchpad for collaboration, innovation, and organic growth in the wealth management industry.

As a Consortium member, you become part of a dynamic community that convenes monthly for virtual Consortium strategy sessions. These sessions are your platform to discuss the latest research, share success stories, and learn from the experiences of your peers. You’ll also have a voice in guiding future research, ensuring it remains relevant and beneficial to your needs.

Your membership equips your executive team and financial advisors with the insights they need to excel. You’ll gain access to our Wealth Management Mastery Series studies and thought leadership tools, empowering your team to stay abreast of industry trends and best practices.

In 2024, we’re taking our collaboration to the next level with a two-day Wealth Management Consortium conference. This event will provide an unparalleled opportunity for networking, learning, and strategic discussions.

The Wealth Management Consortium is more than a membership—it’s a partnership in growth and success. So, secure your place today and join a community of leaders committed to driving success in the financial services industry.

CEG INSIGHTS IN ACTION:

Elevating Financial Advisory Excellence

Empowering Senior Executives to Amplify Advisor Success

Experience how CEG Insights becomes an essential partner for senior executives committed to propelling their financial advisors forward. This showcase goes beyond individual triumphs to reveal the transformative impact of our bespoke research and specialized training on enhancing advisory services from the leadership level. We demonstrate the power of strategic application, equipping advisors with a decisive competitive edge. Delve into stories of development, breakthroughs, and remarkable accomplishments, illustrating how visionary leadership, armed with our insights, leads advisors to unparalleled success and distinction in wealth management.

Taylor Ranker’s Transformation:

A CEG Insights Success Story

Discover how Taylor Ranker, leveraging CEG Insights, created a successful enterprise catering to high-net-worth individuals, with the recent trio of clients each averaging a net worth of $60 million.

Read more.

Lisa Kirchenbauer: Mastering Estate

Settlement with CEG Insights

Witness the transformative power of CEG Insights through the success story of Lisa Kirchenbauer, who has seen her firm’s revenue increase by nearly 20% annually.

Read more.

Matt Nordmann: Delivering

High-Net-Worth Solutions

with a Virtual Family Office

Matt Nordmann’s innovative approach to serving

high-net-worth clients through a Virtual Family Office, guided by

the strategic insights from CEG.

Read more.

Drive Unprecedented Growth with

Step into the Founders’ Club, where your senior team leads the charge toward transformative wealth management growth, followed by your advisors’ empowered stride. This membership prioritizes equipping your leadership with the strategic insights and tools necessary to spearhead organic growth, subsequently cascading excellence throughout your advisory ranks. With access to our exclusive research and innovative strategies, plus an invitation to the prestigious CEO Summit, we offer a unique platform for your senior executives and advisors to excel. This initiative is more than a membership—it’s a commitment to reshaping your firm’s future, ensuring you set new standards and lead confidently in the competitive landscape. Start a conversation with our experts today to explore how your firm can achieve dynamic growth and success from the top down.

Taylor Ranker’s Transformation

A CEG Insights Success Story

In the challenging financial advisory landscape, Taylor Ranker, President of Questmont The Virtual Family Office, is a testament to strategic partnerships and resilience. Amidst a global financial crisis in 2010, Ranker navigated through significant hurdles, driven by a vision to build a sustainable enterprise and a legacy,

In the challenging financial advisory landscape, Taylor Ranker, President of Questmont The Virtual Family Office, is a testament to strategic partnerships and resilience. Amidst a global financial crisis in 2010, Ranker navigated through significant hurdles, driven by a vision to build a sustainable enterprise and a legacy,

Ranker’s strategy was rooted in forming strategic partnerships with CPAs and attorneys, a tactic he learned from the research provided by CEG Insights. In addition, he embraced a holistic approach to wealth management and networked with influential professionals who could connect him with affluent clients.

With the guidance of CEG Insights, Ranker honed his skills and implemented effective strategies for growth. Today, Ranker leads an 11-person operation serving high-net-worth business owners. “The average net worth of the last three clients we onboarded was $60 million,” Ranker reflects, highlighting his firm’s growth.

Despite numerous challenges, Ranker’s firm is a thriving organization, embodying authenticity, creativity, and empowerment. This success story, powered by strategic partnerships and insights from CEG Insights, is a beacon for financial advisors aiming for growth and success.

Lisa Kirchenbauer

Mastering Estate Settlement with CEG Insights

In wealth management, Lisa Kirchenbauer, founder of Omega Wealth Management, stands as a testament to the power of addressing overlooked needs. Her firm’s focus on estate settlement – a niche yet crucial area – has positioned her as a trusted solutions provider.

In wealth management, Lisa Kirchenbauer, founder of Omega Wealth Management, stands as a testament to the power of addressing overlooked needs. Her firm’s focus on estate settlement – a niche yet crucial area – has positioned her as a trusted solutions provider.

Kirchenbauer’s strategy was rooted in a unique fee structure, a comprehensive service offering, deep client engagement, and cultivating high-value referrals. These strategic moves learned from CEG Insights allowed her to deliver impactful services from the onset while positioning her firm for future growth.

Beyond investment advice, Kirchenbauer expanded Omega’s services to include life planning and financial transitions. This approach met her clients’ immediate needs and paved the way for introducing multigenerational legacy planning solutions.

Through a comprehensive discovery process, Kirchenbauer could understand her clients more deeply. This, coupled with her training as a Registered Life Planner® and Certified Financial Transitionist®, equipped her with unique skills to help clients navigate the emotional and personal side of transition – a critical aspect of estate settlement.

By cultivating relationships with centers of influence (COIs), Kirchenbauer was introduced to affluent prospects, allowing Omega to serve fewer but more affluent clients. This strategic approach led to Omega’s revenue increasing by nearly 20% annually in recent years.

Lisa Kirchenbauer’s success story, powered by strategic insights from CEG Insights, is a shining example of how addressing an overlooked need in the market can lead to significant growth and success.

Jesse Abercrombie

Mastering Niche Market Success with CEG Insights

In the competitive financial advisory world, Jesse Abercrombie, a financial advisor with Edward Jones in Plano, Texas, has carved a niche by serving business owners in the commercial construction industry. This strategic decision, backed by insights from CEG Insights, has propelled Abercrombie to become the go-to financial advisor in his niche.

In the competitive financial advisory world, Jesse Abercrombie, a financial advisor with Edward Jones in Plano, Texas, has carved a niche by serving business owners in the commercial construction industry. This strategic decision, backed by insights from CEG Insights, has propelled Abercrombie to become the go-to financial advisor in his niche.

Abercrombie’s success lies in his deep understanding of his client’s unique needs, a knowledge he has honed over the years. In addition, he is well-respected for regularly contributing to industry-specific content. This positioning increases his visibility and strengthens his credibility with his clients.

Abercrombie’s commitment to his niche is evident in his work with successful entrepreneurs. For instance, he helped the owner of a $70 million firm build a $15 million portfolio as a safety net, demonstrating his ability to deliver value and advocate for his client’s best interests.

Abercrombie’s approach to serving his niche includes joining relevant professional organizations, becoming a thought leader, and conducting interviews with industry influencers. These strategies and a comprehensive discovery process enable him to deliver personalized experiences to his clients, setting him apart in the industry.

Abercrombie’s success story is a testament to the power of serving a niche market. His journey, guided by the research and tools provided by CEG Insights, inspires financial advisors looking to differentiate themselves and deliver exceptional value to their clients.

Matt Nordmann

Delivering High-Net-Worth Solutions with a Virtual Family Office

Matt Nordmann, the co-founder of Morrison Nordmann Wealth Management, has distinguished his firm by leveraging the research provided by CEG Insights. Recognizing the unmet needs of high-net-worth clients, Nordmann’s firm operates as a Virtual Family Office (VFO), providing a comprehensive suite of services that directly address these needs.

Matt Nordmann, the co-founder of Morrison Nordmann Wealth Management, has distinguished his firm by leveraging the research provided by CEG Insights. Recognizing the unmet needs of high-net-worth clients, Nordmann’s firm operates as a Virtual Family Office (VFO), providing a comprehensive suite of services that directly address these needs.